DataPlatform simplifies tax returns by verifying and matching data, as well as identifying individuals.

This allows the Dutch Tax Office, Belastingdienst, to accurately pre-fill millions of returns.

For over two centuries, the Dutch tax office Belastingdienst has been a pillar of the Netherlands' financial well-being. Their commitment to collecting and levying state taxes and contributions fairly and precisely ensures that funds are available for vital services such as healthcare, education, and public transport.

A key aspect of Belastingdienst's operations is processing millions of returns annually, a complex task that involves linking vast amounts of data from multiple sources to records. To streamline this process and ensure accurate matching of external information with internal data, Belastingdienst has adopted Human Inference's DataPlatform software solution.

Dive into the details and discover how DataPlatform revolutionizes tax processing for Belastingdienst.

DataPlatform is an all-in-one data quality solution that uses natural language processing and fuzzy logic to improve contact information accuracy. It corrects contact data by identifying and correcting errors and matching similar records. This leaves only precise, unique, and correct relation data. As a result, organizations can operate more efficiently, and customers are more satisfied.

Efficient handling and processing of returns starts with using the correct data.

Belastingdienst maintains an extensive database of data on taxpayers, including citizens and businesses. As this information often changes due to relocations or divorces, regular data updates are crucial.

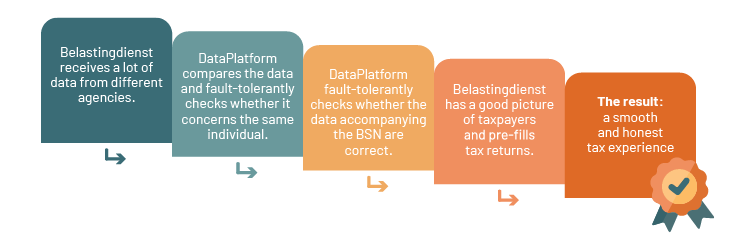

The advanced DataPlatform software compares information from different sources. It matches, checks, and validates data and selects the right person. It ensures up-to-date records and guaranteed data quality. This works as follows:

Belastingdienst receives a diverse range of data from taxpayers through various bodies, such as salary data from employers and bank data from banks. All this information, in its varied formats, needs to be matched, verified, and validated.

Belastingdienst uses Data Platform for the identification and verification process.

The software compares personal data from different sources, such as the employer's and the bank's, to verify individuals' identities. This is done through a matching engine that compares information fault-tolerantly and identifies the individual. DataPlatform also verifies the citizen service number (BSN) by comparing it fault-tolerantly with the supplied personal data.

Once a year, during the tax return season, the Belastingdienst receives a large amount of personal information from various agencies. DataPlatform assists in matching, checking, and validating data with existing information. This is crucial for the Belastingdienst to gain a comprehensive understanding of each taxpayer in the system and to accurately complete and prepare returns in advance. This may not make filing returns more fun, but it does make them easier.

The Belastingdienst wants to provide everyone with a smooth and honest tax experience. DataPlatform helps them achieve that goal by verifying information and identifying individuals. In doing so, they improve every pre-completed return and process the millions of returns efficiently and correctly.

A visual summary of this complete process:

The software makes the tax return process easier by linking the correct data to the Belastingdienst database. This allows them to process and pre-fill returns faster.

The software identifies and verifies all data, ensuring the Belastingdienst always has accurate taxpayer information for correct tax returns.

The software carefully checks data and ensures correct records, allowing Belastingdienst to perform tasks smoothly.

![]()

Want to witness DataPlatform in action and discover its benefits for your organization? Contact us today to learn more and experience the difference firsthand!

Are you struggling to manage the vast amount of data your business collects? With stricter regulations, managing your information effectively is more critical than ever. Luckily, a software solution can help: Master Data Management (MDM).

Don't hesitate to contact us to schedule a brief introductory meeting on how MDM can help your business succeed. Without any other commitments, but with helpful guidance.

Poor data quality costs organizations hundreds of thousands of euros per year. Unreliable data leads to incorrect decisions and inefficient processes.

Fortunately, our data quality checklist allows you to assess in just 5 minutes whether your data meets the 6 data quality dimensions. Please leave your details to download the document instantly.

A robust compliance process is crucial for safeguarding your organization against potential risks. Our team of experts is here to provide you with personalized guidance and the necessary tools to create a future-ready compliance policy, including CDD.

Fill out your details below, and let’s schedule a brief introductory meeting. There’s no obligation—just valuable insights tailored to your needs.