DataHub streamlines the credit application process for Stichting BKR,

enabling credit providers to make reliable credit decisions.

Stichting BKR is an independent organization that collects and manages consumer credit information. Since 1965, they have been committed to a financially healthy Netherlands. Their goals are to protect consumers from over-indebtedness and to promote responsible lending.

The credit bureau is responsible for registering credits, such as loans, credit cards, and leases, in the Central Credit Information System (CKI). Credit providers use this information to evaluate the creditworthiness of their customers, which they are legally required to do. Based on data from Stichting BKR, credit providers determine whether approving an additional loan is responsible and appropriate for an individual's financial situation.

By the end of 2022, 7.8 million Dutch citizens had consumer credit, which amounted to 11.7 million contracts 1. The credits are divided among multiple credit providers. Stichting BKR must provide insight into this data and create a complete file for each borrower to evaluate a credit application accurately. For this purpose, they use the Human Inference software solution DataHub.

This customer case outlines how the CKI and Human Inference software collaborate, how Stichting BKR provides insight into the borrower file – the credit application process – and the collaboration results to date.

Experience the beautifully formatted presentation of this case

Dive into the details and discover how DataHub transforms

the credit application process for Stichting BKR.

Explore the BKR case

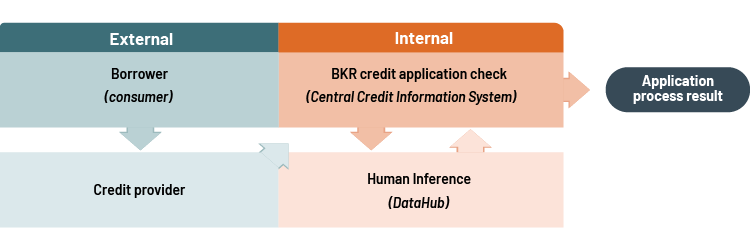

The Human Inference DataHub software integrates seamlessly into the CKI and is part of daily BKR processes. The software and system work together as follows:

Credit providers register credit information in the CKI. Credit providers record credit-related information on newly closed loans in this registration process and may also delete or modify previously registered data.

DataHub gathers and arranges all credit information about a single consumer. This task may seem simple, but identifying the same consumer can be challenging due to constant changes in their lives, such as moving, getting married, or getting divorced. The software ensures the accurate capture of credit information, regardless of the changes in a consumer's situation.

Consumers have the right to request their credit information from the credit bureau. When a consumer requests access to their credit information, DataHub guarantees that only their information is provided.

Did you know that: the BKR affiliated credit providers conduct between

3-8 million monthly credit reviews?

Credit providers consult Stichting BKR for insights on a consumer's credit information during the credit application process. This helps them make responsible credit decisions. However, credit providers often provide limited or incorrect data, whereas DataHub is crucial in providing accurate information.

The software displays the credit information of the best-matched consumer based on the data provided by the credit provider, even if this data is incomplete or inaccurate. The software will only display the credit information of the consumer in question.

The software plays a crucial role in coordinating all credit information, which ultimately leads to an improvement in the services provided by Stichting BKR because:

Every year, before the declaration campaign begins, Belastingdienst receives personal data from different agencies. Belastingdienst must match, verify, and validate this data with what is already in their system. This process ensures that they have an accurate record of each taxpayer and allows them to pre-fill and prepare tax returns with precision.

When a consumer applies for credit, the CKI and DataHub collaborate to verify the consumer's creditworthiness for the credit provider. This helps to prevent irresponsible lending practices. The credit application process involves the following steps:

Credit application

A consumer applies for credit through a credit provider.

Creditworthiness check

The credit provider assesses the consumer’s creditworthiness by checking their application information via the CKI to determine if a loan is justifiable.

Deploying DataHub

DataHub utilizes the application data to conduct a fault-tolerant search in Stichting BKR's administration for retrieving credit information about the consumer. This fault-tolerant search ensures that discrepancies between the application data and the BKR administration do not hinder the credit application process.

Stichting BKR had already improved its administration using DataHub to retrieve consumer credit information efficiently.

The speed of the search process

Stichting BKR requires that consumer credit information searches take no more than 0.25 seconds. On average, searches via DataHub take only 0.2 seconds.

Stichting BKR uses DataHub to provide credit providers with reliable credit information, increasing their confidence in the credit application process.

The credit application process visualized:

In a single day, there are...

Ensuring data security is Stichting BKR's top priority. DataHub provides access to authorized organizations only while keeping the data secure.

Stichting BKR can be confident that credit information is accurately recorded with the corresponding consumer.

Stichting BKR is processing more requests with no increase in employees. As a result, the percentage of automated credit checks and views has risen.

![]()

Get a hands-on look at DataHub and request a demo now

Want to witness DataHub in action and discover its benefits for your organization?

Contact us today to learn more and experience the difference firsthand!

Are you struggling to manage the vast amount of data your business collects? With stricter regulations, managing your information effectively is more critical than ever. Luckily, a software solution can help: Master Data Management (MDM).

Don't hesitate to contact us to schedule a brief introductory meeting on how MDM can help your business succeed. Without any other commitments, but with helpful guidance.

Poor data quality costs organizations hundreds of thousands of euros per year. Unreliable data leads to incorrect decisions and inefficient processes.

Fortunately, our data quality checklist allows you to assess in just 5 minutes whether your data meets the 6 data quality dimensions. Please leave your details to download the document instantly.

A robust compliance process is crucial for safeguarding your organization against potential risks. Our team of experts is here to provide you with personalized guidance and the necessary tools to create a future-ready compliance policy, including CDD.

Fill out your details below, and let’s schedule a brief introductory meeting. There’s no obligation—just valuable insights tailored to your needs.